Since the beginning of the year, Vietnam’s cassava and cassava product exports have faced pricing disadvantages. Specifically, the export prices has been dropping sharply. In the first seven months, the average export price of cassava and cassava products to China reached $304.6 per ton. Negatively, they went down nearly 34% compared to the same period in 2024.

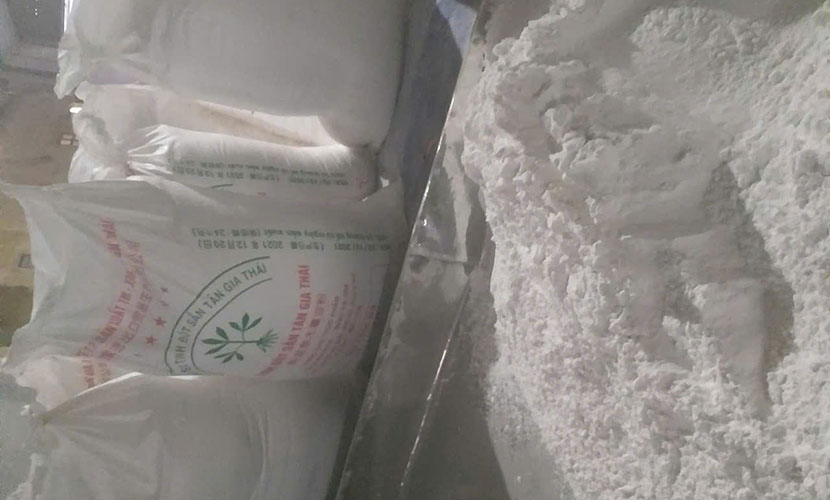

Notably, the export price of cassava starch has remained between $385–395 per ton since early August. It was much lower than the approximately $500 per ton recorded in August 2024.

Vietnam’s cassava

Amid this price decline, a bright spot is the significant increase in export volume. In the first seven months, Vietnam’s cassava exports exceeded 2.48 million tons, up nearly 55% year-on-year. As a result, despite the steep price drop, export revenue still increased slightly by 2.8%, reaching $757 million.

In the first half of 2025, China’s imports of cassava and cassava starch grew strongly. Particularly, they imported 6.19 million tons, worth $1.69 billion. Positively, they went up 91% in volume and 28% in value compared to the same period in 2024. This sharp increase underscores the growing importance of cassava products in China’s supply chains for the food processing, animal feed, and bioenergy industries.

Vietnam’s cassava industry has ramped up exports of cassava starch and dried cassava slices to the Chinese market. In the first half of this year, Vietnam overtook Thailand to become the largest supplier of cassava starch to China. Vietnam exported 1.34 million tons to China, a 110% increase compared to the same period in 2024. Notably, it accounted for 48% of China’s total cassava starch imports.

For dried cassava slices, Vietnam exported 662,000 tons to China in the first half of the year. It showed a 137% increase over the same period in 2024. Vietnam remains the second-largest supplier of dried cassava slices to China.

Dried cassava slices from Vietnam

Vietnam’s cassava product exports will continue to rely heavily on the Chinese market. Currently, China accounts for over 90% of total cassava export volume and value.

China currently has high inventory levels, with around 450,000 tons of cassava starch stockpiled at major ports. Along with abundant supply from Thailand and Laos, this has intensified competition. In response, Vietnamese enterprises are stepping up efforts to diversify export markets.

Market diversification also helps Vietnamese exporters reduce pressure from Chinese traders who often push down prices. Ms. Khue, Director of Dinh Khue Co., Ltd, stated that the company is expanding cassava starch exports to Taiwan, where prices are 10–15% higher than those offered by Chinese buyers.

Taiwan’s demand for cassava starch is rising, especially cassava strach from Vietnam. In the first seven months of this year, Vietnam was the second-largest supplier of cassava starch to Taiwan. Vietnam exported 31,000 tons, a 21% increase in volume compared to the same period in 2024. Vietnam’s market share reached 16% of Taiwan’s total cassava starch imports, up from 14% in the same period last year.

Vietnamese cassava starch

At the same time, companies are boosting domestic sales of cassava products. According to Ms. Khue, while domestic sales previously accounted for around 40% of Dinh Khue’s total output, this year they have risen to 65–70%.

In addition to supplying food processing and animal feed manufacturers, Vietnamese cassava companies are also looking forward to the resumption of ethanol biofuel production plants. From November 2025, the E10 biofuel program is expected to enter a high-activity phase, increasing demand for ethanol.

This presents an opportunity for Vietnam’s cassava industry to boost domestic consumption and reduce export pressure. It may also help secure better export prices in the future.

Link: https://nongnghiepmoitruong.vn/xuat-khau-san-lay-luong-bu-gia-d768060.html