Despite facing challenges from the U.S. retaliatory tariff policy, Vietnam’s cashew exporters remain optimistic. They expect the 2025 export turnover of cashew nuts to stay on par with 2024 levels.

In May 2025, Vietnam exported 81,116 tons of cashew kernels, valued at $550.836 million. These figures showed an increase of 10.5% in volume and 11.5% in value compared to April 2025.

For the first five months of the year, total cashew kernel exports reached 276,761 tons, worth $1.884 billion. They went down 5.3% in volume but up a sharp 19.4% in value compared to the same period in 2024.

Cashew nuts from Vietnam

In the U.S. market specifically, in May, Vietnam’s cashew exporters reached 17,361 tons, valued at $117.606 million. These showed a 3.37% decrease in volume but a significant 22.32% increase in value compared to May 2024, thanks to higher export prices.

Cumulatively over the five months, the U.S imported 59,752 tons with a turnover of $406.889 million, down 20.40% in volume but still up 1.72% in value year-over-year.

Prior to 2nd April of 2025, Vietnam’s agricultural exports to the U.S., including cashews, enjoyed a 0% import tariff. However, the U.S. recently imposed a temporary 10% tariff on this product. The Vietnamese government is actively negotiating to maintain preferential tariff rates.

Mr. Huyen, Chairman of a Vietnamese cashew company, stated: “It’s unclear how the negotiations between the two governments will turn out. However, I believe that the maximum tariff the U.S. will apply to Vietnamese cashews will be around 10%. Notably, cashews are an essential item that the U.S. cannot produce on its own.”

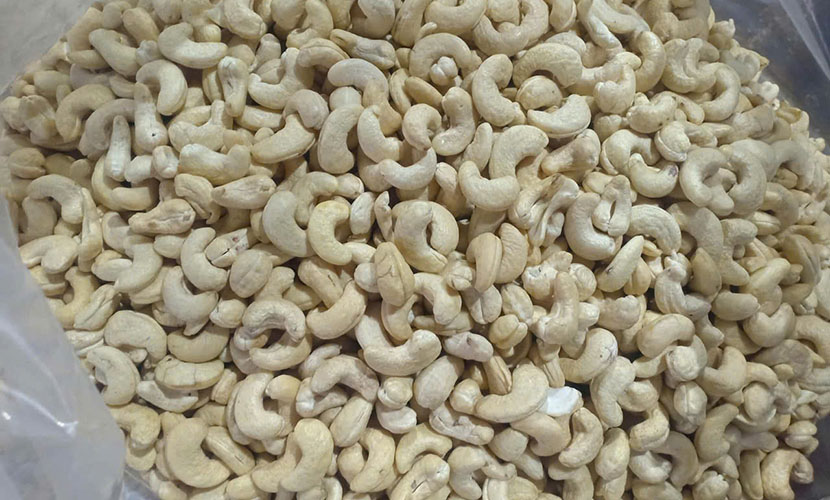

Main types of Vietnam’s cashew kernels

Despite the 10% tariff, Vietnam’s cashew exports to the U.S. have continued as normal. Importers who had already signed contracts are still receiving shipments and agreeing to pay the additional tariff. However, if negotiations fail to achieve a more favorable outcome, export prices may need to be reduced to offset the additional costs.

Mr. Huyen added: “When tariff policies are stable, U.S. importers will feel more confident placing orders. Simultaneously, they are able to plan for long-term imports of Vietnamese cashew products. Signing contracts now is risky due to any future unfavorable policy changes. As a result, these will raise prices that could hurt consumption and result in losses for exporters.”

Vietnamese cashew carton boxes

Since the U.S. began applying the 10% tariff on Vietnamese agricultural products, overall exports to the U.S. have remained positive. In fact, many agricultural products have seen a surge in demand due to concerns that tariffs may rise further after July 8. However, cashew nuts have not experienced the same level of buying interest from U.S. importers as other products.

The new tariffs led to a slight decrease in cashew export volume to the U.S. in May 2025, but the total export value increased thanks to higher export prices. U.S. buyers are still waiting for clearer policy signals from the Trump administration. Meanwhile, cashew exports to China surged significantly compared to the same period in 2024. In the meanwhile, the U.S. and European markets remained relatively flat or slightly down.

Another factor supporting the cashew industry is the recent decline in raw cashew prices. This benefits companies importing raw materials for production, especially in preparation for the year-end festive season. Typically, demand for cashews remains relatively low in the first half of the year. Therefore, importers are often hesitant to buy in large quantities during this period.

Vietnamese cashew tin boxes

As a result, exporters are hopeful that the cashew market will pick up in the second half of 2025. Falling raw cashew prices are a positive factor. However, many Vietnamese cashew factories had already signed raw material purchase contracts when prices were still high.

Mr. Huyen shared: “At the time of signing, raw cashew prices were $1,450 per ton. Currently, the price has dropped to $1,350 per ton, a decrease of $100 per ton.”

In 2024, Vietnam’s cashew exporters made a record-breaking 730,000 tons of cashew kernels. They earned was $4.37 billion in value, a 20.2% increase compared to 2023. The U.S. consistently ranked as one of the top three largest importers of Vietnamese cashews, alongside China and the Netherlands.

Loading Vietnamese cashew nuts

According to Vinacas, in recent years, the U.S. has accounted for approximately 30% of Vietnam’s total cashew export revenue. In 2023 alone, the U.S. imported over 130,000 tons of Vietnamese cashews, valued at more than $700 million.

The U.S. remains a key market for Vietnamese cashew kernels due to its large and stable market. Also, demand for healthy nuts, with cashews being especially popular for their high nutritional value. Vietnam is currently the world’s number one exporter of cashew kernels. Vietnam has its strong capabilities in deep processing and its adherence to strict food safety standards. As a result, they are essential factors in meeting the stringent requirements of the U.S. market.

Amid U.S. tariff adjustments, which have raised concerns among Vietnamese processors and exporters. However, Vinacas still remains optimistic that Vietnam’s cashew export turnover in 2025 will match the strong performance seen in 2024.

Vietnamese source: https://thitruongtaichinhtiente.vn/doanh-nghiep-xuat-khau-hat-dieu-lac-quan-ve-trien-vong-nam-2025-68445.html